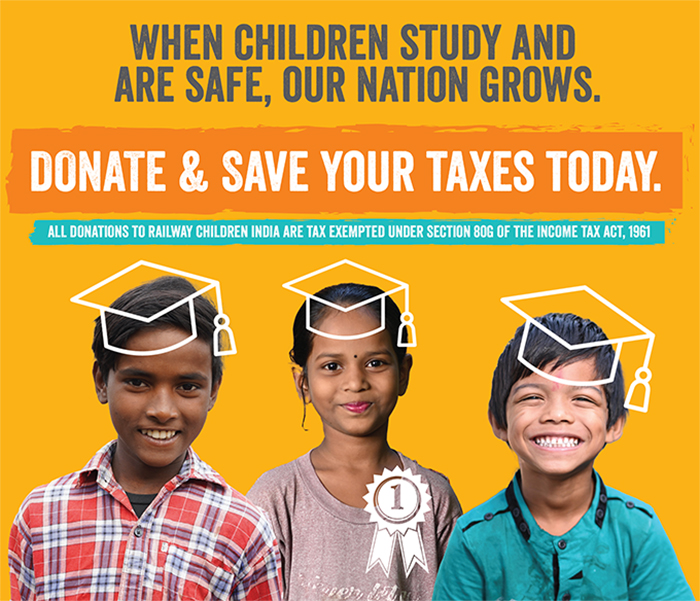

Discerning, well-intentioned, and passionate donors like you, contribute immensely towards tangible change and upliftment in marginalized communities. Whether it’s the varied health camps held in bastis or the much-loved school bag distribution drives, RCI’s goal of leaving impactful imprints in communities is not possible without generous, heartfelt donations from you, readers. A donation is a step in the right direction, yes. It is also a means of reducing your tax burden.

Read on to learn more about Section 80G that enables tax exemptions and amplifies the impact of your donations.

What is Section 80G of the Income Tax Act?

For those who contribute a sum of their income towards society’s welfare, Section 80G is an affirmative, encouraging nod from the government. This section boosts philanthropy by providing tax deductions on donations made to select charitable institutions, all of which are a part of the 80G exemption list.

What does the Income Tax Act say?

As for 80G tax exemption limit, donors can claim deductions up to 50% or 100% of the donated amount, depending on the nature of the recipient organisation and the prescribed limits.

Which NGOs qualify for approval under Section 80G of Income Tax Act?

For an NGO to qualify for approval under Section 80G of the Income Tax Act, it should be registered under the Societies Registration Act 1860, or under Section 25/8 of the Companies Act 1956/2013, or under Indian Trusts Act 1882. The qualifying NGO, like Railway Children India, should also fulfil the conditions mentioned in sub-section (5) of Section 80G of Income Tax Act.

Who is eligible to claim an 80G tax deduction?

If you are a taxpayer, you are eligible to claim a tax deduction under Section 80G. Individuals, companies, firms, Hindu Undivided Firm, Non-Resident Indian, and any other taxpayer is eligible to claim tax deduction under Section 80G.

Note: Non-resident Indian (NRI) must hold an Indian passport and have taxable income in India to be eligible for exemption under Sec 80G of Income Tax Act.

What kind of donations fall under 80G limit? Or What is 80G deduction limit?

For your donations to be eligible for tax deduction under Section 80G it should ideally be made to approved recipients/donees. Furthermore, the receiving organisation must provide the donor with a receipt and a donation certificate, both being mandatory to claim the deduction.

Donations made through cheque, draft, cash or online are eligible for deduction under Section 80G.

Note: For cash donations, maximum donation under 80g is Rs. 2000 i.e., if a cash donation exceeds Rs. 2,000, it is not eligible for deduction under 80G. Donations above Rs. 2,000 must be made through modes other than cash to claim the deduction.

Donations made in kind (i.e., non-cash contributions) cannot be deducted under 80G.

How does Railway Children India help you save tax?

Railway Children India is a registered non-profit organisation recognised under Section 80G of the Income Tax Act of India. If your taxable income is ₹10,00,000 and you donate ₹10,000 to CRY India, your net taxable income will reduce to ₹9,95,000, lowering your overall tax liability.

To save income tax, all you need to do is provide your PAN details when donating to RCI. Once donated, RCI will issue an 80G tax receipt and 80G certificate that can be submitted along with your income tax return filing.

Remember, tax savings is a bonus with RCI! At the core, your donation under 80G to RCI supports the protection of child rights and contributes to a world where no child is left behind.

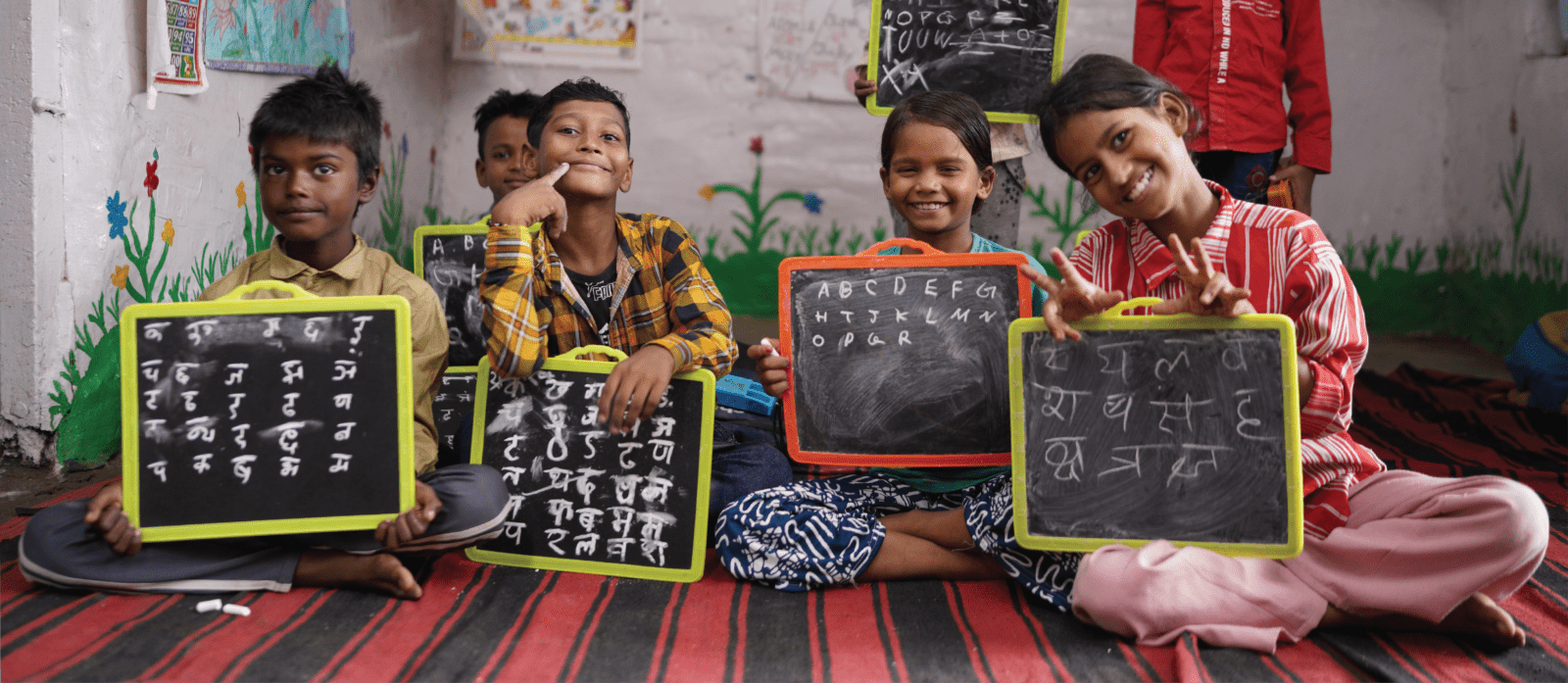

In all of its endeavors, RCI is motivated to find the most effective solutions and practices to break the cycles of abuse, neglect, and breakdown among children. It is an undeniable fact that all children have the same rights. However, it is nearly an everyday ritual to see children from underprivileged homes lose their rights easily to poverty, child labour, malnutrition, climate crisis and so much more. To break this vicious cycle, RCI is motivated to create systemic change, and give a voice to children, adolescents and young adults. Your donation, no matter the amount, helps us achieve our goals of child protection and welfare.

Some more FAQs on how to save tax

How do donations to NGOs help save taxes?

Donations made to a registered NGO in India are eligible for a tax deduction of up to 50% of the donated amount under Section 80G of the Income Tax Act. This deduction is available to both individuals and businesses.

Which donation is 100% tax exemption?

Donations to the government or to any local authority, institution, or association approved in this regard by the Central Government to promote family planning are eligible for a 100% deduction. However, this is subject to a qualifying limit of 10% of adjusted gross total income.

What is the minimum donation amount to get a tax exemption under Section 80G?

There is no specified minimum amount to avail of tax exemption under IT section 80G for online donation.

What is the maximum amount for income tax exemption under 80G?

For individuals, the deduction under Section 80G can be claimed on the amount donated to eligible institutions or funds up to a maximum of 50% or 100% of the donated amount, depending on the institution or fund to which the donation has been made

Is there a tax exemption on cash donations as well?

No tax benefit for cash donations exceeding Rs 2000 shall be allowed to the taxpayer. The payment for a higher amount (exceeding Rs 2000) should be made through cheque, net banking, demand draft, or other banking channels.

When can I get a tax exemption certificate?

A registered non-profit organisation can issue an 80g certificate to the individual or company making the donation.

I am an NRI. Will I get a tax exemption on my donation?

Yes, as long as you must hold an Indian passport and have taxable income in India, you’re eligible for exemption under Sec 80G of Income Tax Act.

What are the certificates required to claim tax exemption under Section 80G?

To claim deduction under 80G, you need a donation receipt to back your claim. The receipt should provide details like Name, Address, PAN, registration number of the trust & the name of the donor, as well as the amount of donation and mode of payment.

Conclusion

Section 80G is an encouraging nudge to philanthropy, incentivizing donations made to charitable organisations. By contributing to specified organisations, taxpayers—whether individuals or companies—can reduce their taxable income corresponding to the amount of eligible donation, effectively lowering their tax liability.

This tax-saving bonus is a cherry on top of the affirmative action of contributing to an organisation whose goals, mission, vision, and values you resonate with.